Beer

In some respects, America’s market for beer has never looked healthier. Where fewer than a hundred brewers operated a generation ago, we now can count over 7,400 breweries, double the number there were just five years ago. Yet the market below this drinker’s paradise has, in certain respects, never been more closed. Two giant firms—Anheuser-Busch InBev (ABI) and MillerCoors—now control some 60% of the US beer market. ABI alone sold about 39% of the beers in the U.S. in 2020, and 1 in every 5 beers on the planet. And ABI is working hard to further solidify that control. Over the last several years, the behemoth has purchased several craft breweries, including Chicago’s Goose Island and Seattle’s Elysium, seeking a greater stake in that expanding sector. And in November 2015, ABI reached an agreement to acquire SABMiller for $106 billion. That created a company that sells 30% of all the beers on the planet.

Read More

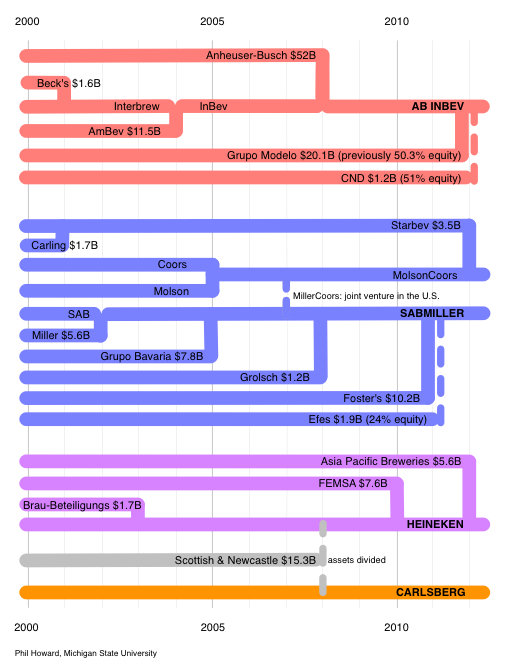

This chart from Michigan State University’s Phil Howard shows how concentration has taken hold of the beer industry in the past 15 years:

Just a few power players didn’t always dominate the beer industry. Almost 80 years ago, after the grand failure of Prohibition, Americans designed the “three-tier” system, a practical way to regulate the sale and consumption of alcohol. This system separated the activities of the brewer and distiller, retailer, and distributor so as to prevent any one company from entirely controlling the industry. It also put control in the hands of the states, with the belief that states were most knowledgeable about how to regulate the alcohol industry to best meet their citizens needs.

But as consolidation continues to shape the industry, corporate brewers have begun to threaten the three-tier system by extending their reach beyond production and into distribution. For instance, ABI is increasingly using exclusive contracts with distributors to keep independent craft breweries off the shelves. While these contracts are optional, they provide lucrative bonuses to distributors that opt to partner with the corporate giant.

And a few giant retailers are rolling up control over sales. In Washington State in 2011, private retailers poured millions into a campaign to end the state’s control over liquor sales. Retailers argued that privatizing the spirits industry would lower prices and raise availability for consumers. Before the new laws were implemented in 2012, liquor was sold in just over 300 state-controlled stores. By 2014 that number had increased to around 1,400 independent retailers, pharmacies, wholesale buying clubs, and groceries. But it soon became clear that liquor prices were rising for consumers – by about 15% by 2015, largely due to distributors and retailers passing on fees meant to compensate the state for its lost tax revenue. Meanwhile, retailers have been the real winners, with Costco alone controlling about 10% of the state’s liquor sales by 2014.

These changes hurt almost all Americans. Independent brewers will find it harder to get to market and to scale up business without being bought by a multinational corporation. Consumers in smaller cities and towns will find it harder to find that special craft beer. And our post-Prohibition safeguards against monopoly control of the alcohol industry will continue to be threatened, challenging laws that have been implemented and protected by local governments for decades.

For an in-depth timeline of acquisitions in the beer sector, check out this timeline by VinePair.

Parts of this essay are excerpted from “A King of Beers?” a report by the Markets, Enterprise, and Resiliency Initiative (now the Open Markets Institute.)