“The Meat of the Future” Risks Capture by Today’s Monopolists

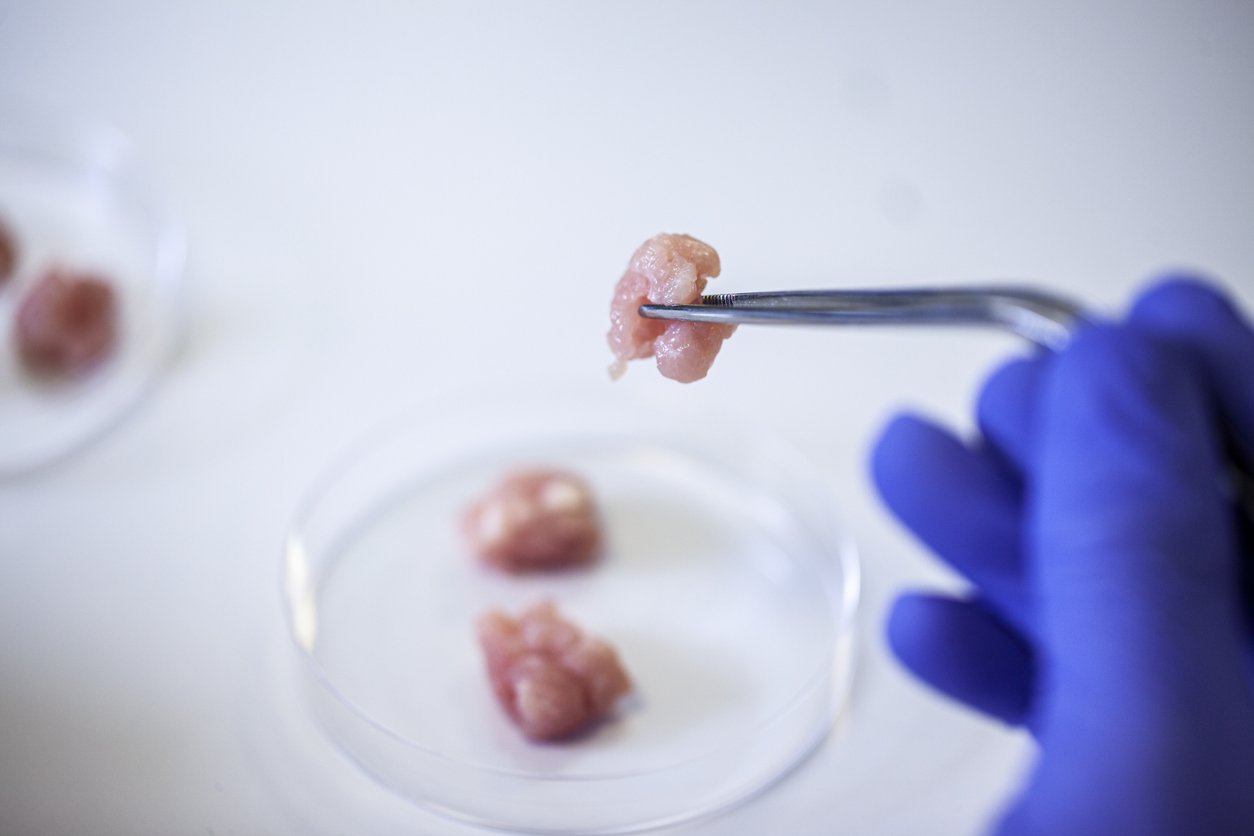

Photo by iStock/Mindful Media

Will Big Meat take over Lab Meat? The answer could depend in part on this year’s Farm Bill.

Producers of lab meat, otherwise known as cellular meat or cultured protein, want more federal investment and research support, and they’ve nearly doubled their spending on lobbying this year to get it through the Farm Bill, according to Politico. As policymakers consider investing in the developing industry, there’s more at stake than simply what research to fund; if we’re not careful, we could end up with a meat industry even more monopolized than it is today.

Making cell-grown protein is an intensive and costly undertaking, requiring huge industrial production facilities, expensive inputs, and complicated technical oversight. Venture capital is funding much of the start-up activity, but large-scale conventional meat companies are also moving in.

JBS, the world’s largest beef processing company, has invested $100 million in BioTech Foods, which this summer broke ground on what’s slated to be the world’s largest lab-grown beef plant. Cargill and Tyson, two of the largest chicken processors in the world, have both invested in cultivated chicken producer Upside Foods, among other start-ups. Professor Phil Howard of Michigan State University notes that large meat firms are “hedging their bets” by investing in both cell-grown protein and plant-based meat substitutes, so that they can maintain their market share and continue to profit, regardless of which protein customers favor.

There are still daunting technological barriers to getting cellular meat to market at the kind of scale that might actually put a dent in conventional meat consumption in the U.S. These challenges include building unprecedentedly large bioreactor facilities to grow the meat; creating new supply chains for the culture growth media, or “food” the cells need to grow; and resolving basic biological constraints around cell density and growth rates. But regardless of how the technological challenges play out, policy choices made today about intellectual property, open access to research, and what mergers and acquisitions to allow, will structure the entire meat industry going forward.

As things stand, Jan Dutkiewicz, a visiting fellow at Harvard Law School, says that the vast majority of funding for cellular agriculture research is coming from venture capital investors. And, he adds, “The one thing you can say is that eventually, all these VCs are going to want to start seeing returns.”

One of the ways VC firms can get their return is by pressuring start-ups to sell to larger, established industry players. Dutkiewicz imagines a scenario in which a VC-funded company manages to bring a successful product to stores, “and then [that company] say[s], all right, well, we’ve got to scale up distribution, and that company sells to ADM” or another existing major agribusiness to fund its growth.

Also possible are “catch-and-kill” scenarios that lead to further monopoly. We have already seen conventional meat firms buy up plant-based alternatives, only to later replace plant-based production with conventional meat processing. Traditional meat companies could make similar moves with cellular agriculture companies they control.

Other dynamics could lead to further monopoly problems. To take advantage of economies of scale, cell-based meat production and supply chains could become extremely concentrated geographically. Howard argues this would lead to supply chain fragility; similarly extreme production concentration imperiled baby formula supplies last year.

Additionally, if cell-based meat draws conscientious customers away from the higher-end, sustainable meat market, then the industry could threaten the business of smaller, more sustainable livestock farms. Howard argues that this would reinforce the dominance of environmentally harmful industrial meat firms, as meat conglomerates could use cellular meat to crowd out sustainable livestock farmers instead of their conventional meat products.

Investor pressures for speedy financial returns could also cause companies to be secretive about their research, leading to duplicative work, higher product development costs, and barriers to entry for new companies. Dutkiewicz argues for increased government funding for basic research and development to reduce cellular agriculture’s reliance on venture funding and the profit demands that come with it. Robert M. Chiles, assistant professor at Pennsylvania State University, goes a step further and suggests that any government funding for basic research at public universities comes with a requirement that the results will be made freely and publicly available, rather than pay-walled in academic journals.

There are other market interventions beyond public research funding that could support a more open and competitive market for cellular meat. Chiles and Dutkiewicz both call for changes in how patents are used in the industry. Chiles envisions a multi-actor cooperative, where “different companies can use and draw on” a shared pool of “intellectual property resources, more shared basic science…[and] shared facilities.”

In this case, cellular meat companies could share in the start-up costs of product development and compete on factors like product quality and sustainability instead of competing for market control through patents. But venture capital will simply not back these kinds of collaborative, “academically pretty” models, says Dutkiewicz. Government funding could prioritize groups with a demonstrated commitment to open-source technology and cooperative structures.

As cell-based meat advocates look to the government for additional financial backing, policymakers should consider what types of market structures they’re incentivizing. And as companies (slowly) start to bring cell-based meat to consumers in the U.S., regulators should carefully review future mergers and acquisitions, especially those involving traditional meat companies, to ensure no meat monopolists take an oversized share of the “protein” market. If the United States does decide to invest in building a new food system from scratch, there’s no reason to copy today’s monopolistic market in pursuit of “the meat of the future.”

What We’re Reading

Time’s Alana Semuels asks, who am I hurting by shopping at Walmart? The answer, turns out, is small, independent grocery stores – and the real culprit is not Semuels but the U.S. government, which has chosen to not enforce a law that could prevent Big Box stores from putting unfair pressure on suppliers.

A new line of Tyson beef with a USDA-approved “climate friendly” label will hit stores this month, but critics argue there’s virtually no reliable way to verify that this product has a lower carbon footprint (and plenty of ways to game the metrics).

Just two years after candy superpower Hershey’s bought Dot’s Homestyle Pretzels for $1.2 billion, they’re closing down the brand’s flagship bakery in Velva, North Dakota to centralize production elsewhere.

The EPA denied a 2017 petition to regulate pollution from industrial-scale farms, instead calling for further evaluation by a new subcommittee. The move helps Big Ag by underwriting the true environmental clean-up costs of their operations, leaving communities with unsafe water.